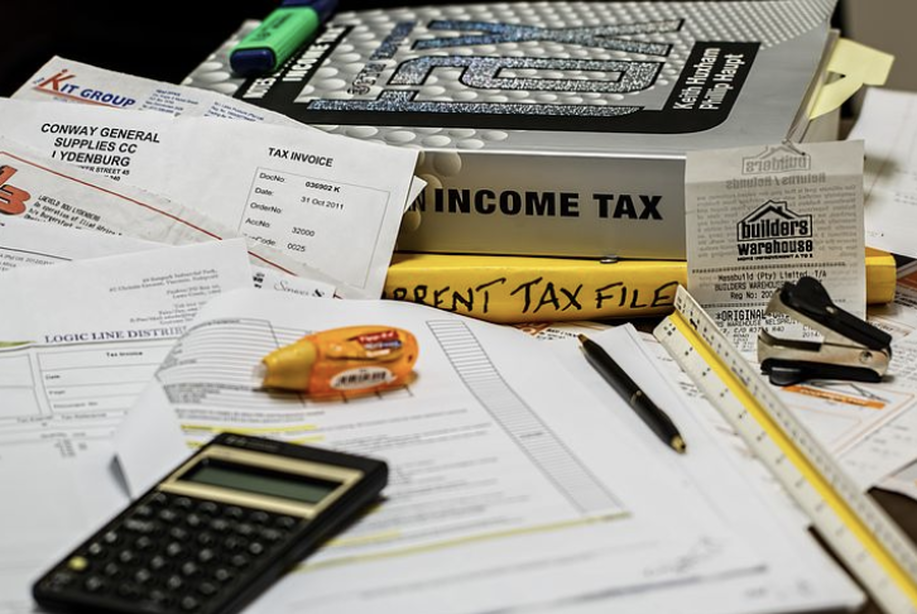

Why Use A Professional Tax Service For Your Business?When it comes to filing taxes for your business, you don’t want to end up with mistakes and money lost. To ensure a proper filing process, using a professional tax service is recommended. At Pathways, instead of just filing your taxes for you, we try our best to help you understand your taxes thoroughly. So, how do you file taxes for a small business, and why is it important to use a professional?

Keep All Records Record keeping is the most important step in the tax filing process for businesses. If there is no record, it never happened, and therefore makes it much more difficult to get correct information. In the process of keeping data, we suggest using a bookkeeping service like Quickbooks to store information used within the filing process. Use The Correct Form It is important to know the differences between the tax forms and which is appropriate for a business. The form most used for small businesses is a Schedule C or Form 1120. Schedule C is a simple form that is easier to calculate and input information. Deadlines are Real To make the filing process the easiest, be aware of the filing deadline for taxes on small businesses. We are very serious when it comes to this because of the repercussions that may occur due to late filing. Pathways is here to help your business breeze through tax season, so why not make your appointment today?

2 Comments

8/11/2020 05:12:26 am

Thanks for helping me understand the benefits of using a professional tax service. I find it amazing to learn that these experts can streamline most of your company's financial tasks, and they could also do any tax-related concerns for their clients. Having an expert you can rely on regarding numbers is indeed a bless ing. I am bad at numbers, and if ever I'll start a business in the future I'll make sure to hire one of these experts.

Reply

9/21/2020 11:38:38 am

It is important to know the differences between the tax forms and which is appropriate for a business. The form most used for small businesses is a Schedule C or Form 1120. Schedule C is a simple form that is easier to calculate and input information.

Reply

Leave a Reply. |

AuthorThe Pathways Team Archives

September 2020

Categories

All

|

|

(843) 261-9293

105 South Cedar St. Suite E Summerville, SC 29483 9:00am- 5:00pm, Monday- Friday |

RSS Feed

RSS Feed