|

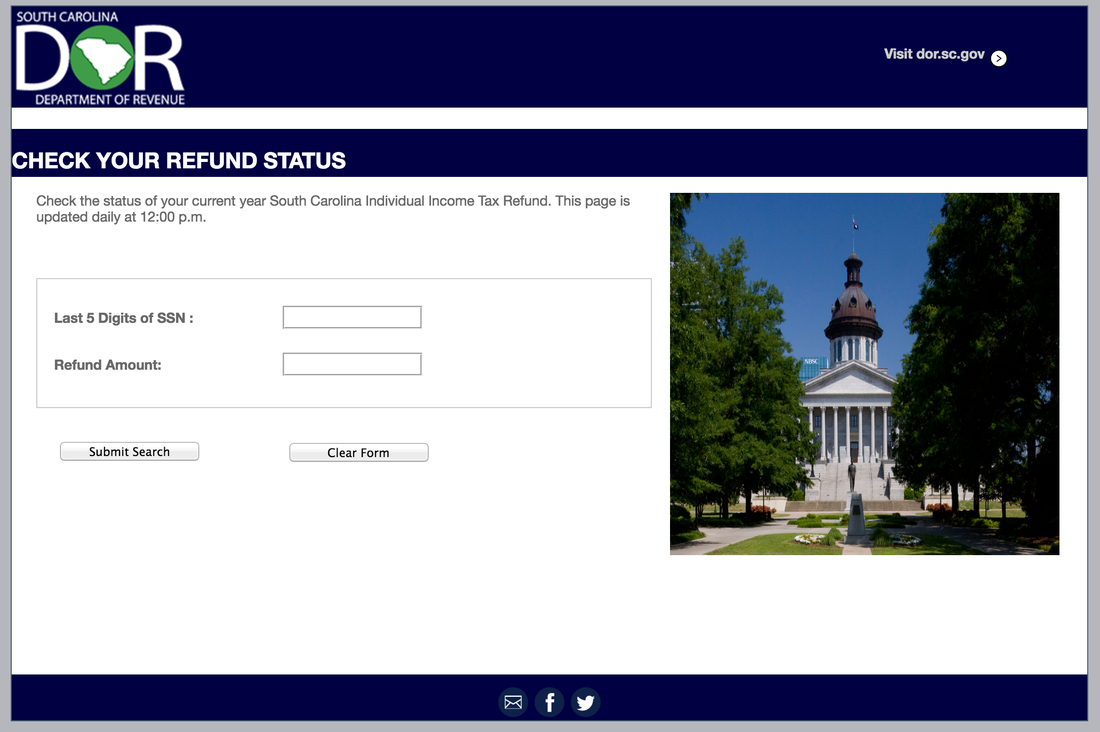

Tax return time can kind of feel like a spring Christmas for many people; we hope your refunds have come back like you all had anticipated! If not, hopefully this precious tax return story from our friends at America Comes Alive can lift your spirits: On April 15, 1951 a 70-year-old couple in Syracuse, New York received a $27 refund check for an income tax overpayment. They returned it to the Internal Revenue Collector, explaining their refusal to accept it as being due to their thankfulness for “the opportunity to continue working.” Also, if you have not yet received your refund in South Carolina, you can check on the status of your refund here. If you have any tax questions or concerns, please contact your Charleston SC tax accountants here at Pathways Consulting!

0 Comments

Happy Red Nose Day from Pathways Consulting! Help us as we support the fight against children in poverty. Get your red nose today (we got ours at Walgreens)

May 26th, 2016 is Red Nose Day: a special day to come together, have fun, and make a difference for kids who need us most. Learn how you can help at http://rednoseday.org/ Tax Season 2016 has come to a close! *Did we hear joyful shouting & celebratory singing in the streets?* Now that most of the hard work is over for those who have completed their tax returns... How about a look back at a few funny moments from the busyness of tax season?

Our friends at accountingweb.com have shared some real-life, humorous experiences from accounting professionals who posted on taxalmanac.org: From user Taocpa: Client changes jobs and gets a huge increase in pay. I call him and joke it must be nice. Client and I share a good laugh and his wife calls. She asks me what's on his W-2. I tell her it's 75K. She said that's impossible and I ask when he started at the new company. She tells me mid-October. I couldn't believe he made $25K a month at that point. So I call him, he looks into it. He puts me on the phone with the bookkeeper. She tells me the IRS told her to add his wages from his previous job to their wages so he won't be over-taxed on Social Security. I couldn't help but explode with laughter. When I explained to her that his previous company already reported those wages and she didn't need to report them, she said that's not what she was told, but she would correct it anyway. Gotta love it. I just found out from my client that the woman who incorrectly prepared his W-2 is an accounting major. I suggested to my client she switch majors. From user: JR1 Had a sister in law as a client, who, like me, is a real know-it-all. And her return popped back due to birth date error for one of her sons, in e-filing. She proceeded to tell me that she had it right, that it couldn't be that, etc. etc. A couple days later, she conceded that she'd had the date wrong all these years! If you happen to run into a few risible situations like these folks, please contact your Charleston SC tax accountants here at Pathways Consulting! http://www.pathwaysconsulting.biz/tax-and-accounting.html |

AuthorThe Pathways Team Archives

September 2020

Categories

All

|

|

(843) 261-9293

105 South Cedar St. Suite E Summerville, SC 29483 9:00am- 5:00pm, Monday- Friday |

RSS Feed

RSS Feed