|

As a small business owner, the ability to read financial statements will give you a better idea of how your business is doing. There are many different financial statements but I've narrowed it down to three to focus on. If you dedicate your time to learning these three statements inside and out it will give you a great idea of the financial position of your small business. This will be a three-part blog series starting with an in-depth look at balance sheets how they are structured and how to use them to your advantage when evaluating your business.

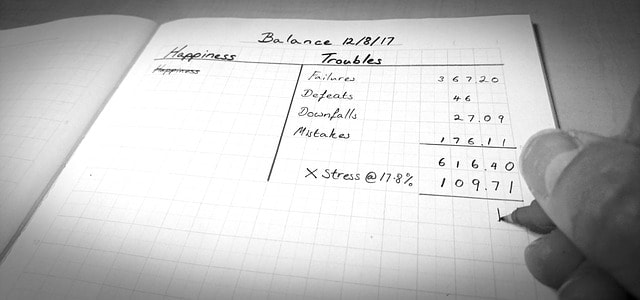

Your Balance Sheet will list out all your assets and expenses. The key to this statement though is that it must balance, hence the name. Your assets must be equal to the amount of liabilities plus shareholders’ equity. If you accounted correctly these should be equal. Now there are different types of liabilities and expenses that you should know. There are fixed and current assets. Fixed assets are things you are not planning on selling or that cannot be sold easily within a year. This would include things like your physical building, equipment you use, etc. Current assets are things you are planning on converting into cash in the near future. This would include your accounts receivable, inventory, or prepaid expenses. The two types of liability are short term and long term. These are much more self-explanatory; the short term are things that must be paid within the next 12 months of the date of the balance sheet i.e. taxes or loans. While long term would be things that must be paid outside of a year from the balance sheet. These are typically things like long-term rent, bonds payable, or pensions. So, what are you looking for exactly in your balance sheet? The shareholder's equity is a rough estimate of the company's net worth. Since the shareholder's equity is the initial amount of money invested in the company. The company can, after taxes, choose to move retained earnings into the shareholder's equity account. Important information can be gained by analyzing ratios. The ratio of debt to equity is where your balance sheet becomes extremely helpful. You want to take your outstanding debt and divide it by your equity. This gives you a ratio, it is important to evaluate your ratio over three years to identify a trend. Each industry differs in what debt-equity ratio is acceptable, be sure to do this research if you are undertaking this task yourself.

0 Comments

Leave a Reply. |

AuthorThe Pathways Team Archives

September 2020

Categories

All

|

|

(843) 261-9293

105 South Cedar St. Suite E Summerville, SC 29483 9:00am- 5:00pm, Monday- Friday |

RSS Feed

RSS Feed